Buying a home is a major financial decision, and it’s important to avoid making mistakes that could cost you money in the long run. For instance, buying my first home…

Latest Articles

Health Savings Accounts, or HSAs, are a hidden investment vehicle too good to pass up. Once you understand how they work, you’ll probably think so, too. In recent years, healthcare…

More Articles

Hate the idea of budgeting? Guess what? Me too. Believe it or not, you don’t have to track where every cent goes meticulously. The Pay Yourself First method offers a…

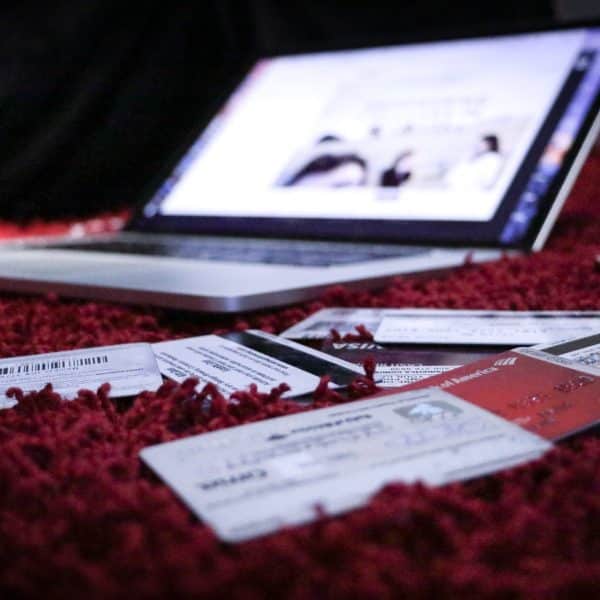

Managing debt can be overwhelming, but choosing the right debt payoff method can make a significant difference in achieving financial freedom. Two popular strategies, the Snowball and Avalanche methods, offer…

So, you want to be a millionaire? Well, you’re in luck! It’s actually not as hard as you might think. Sure, it takes time and effort, but it’s doable. Here…

REITs, or Real Estate Investment Trusts, are companies that own, operate, or finance income-generating real estate. They are designed to allow investors to invest in real estate without the need…